CY2021 Final Operating Budget Proposal

Background

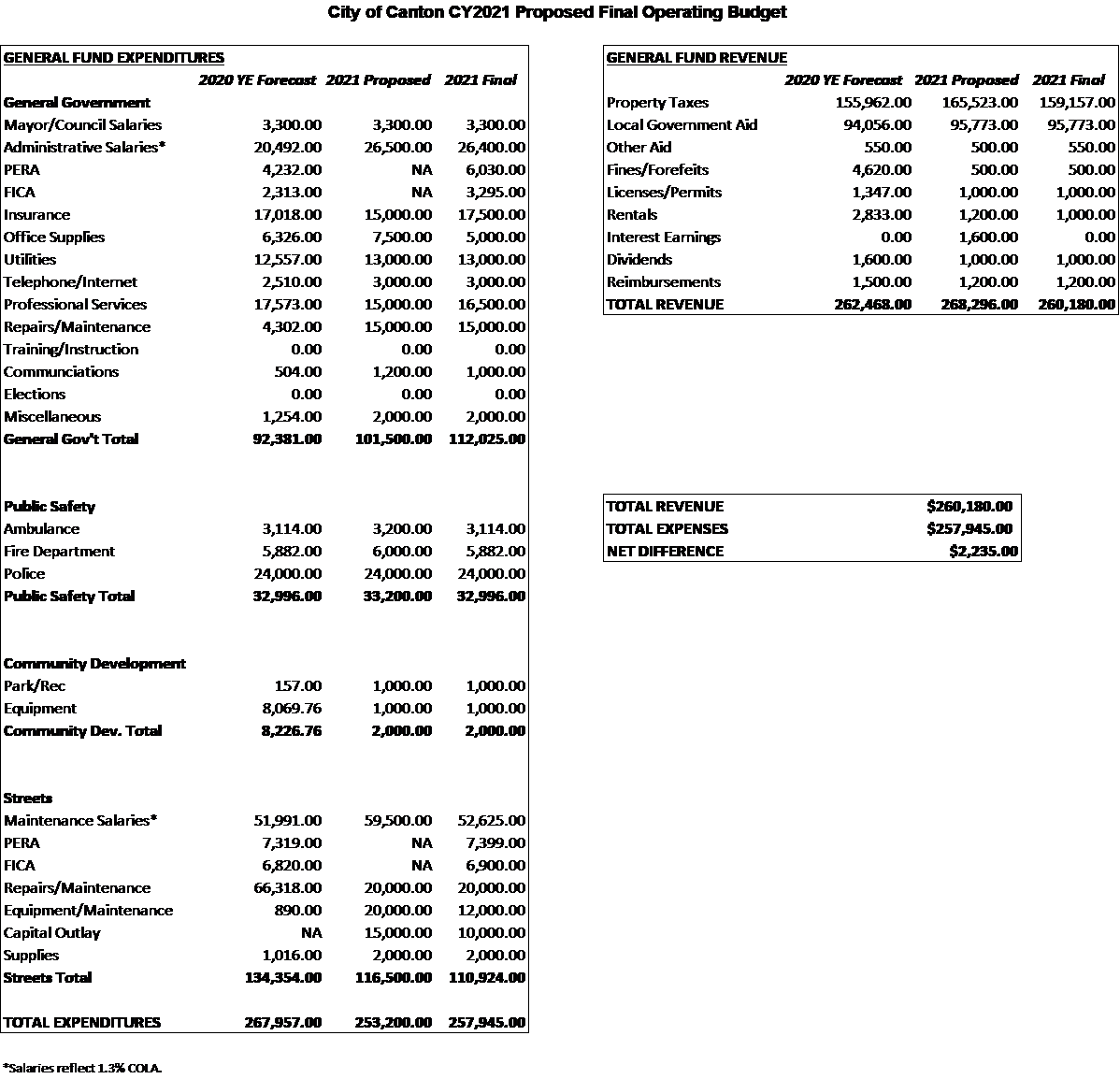

The proposed final operating budget (General Fund) includes planned expenditures and revenues for calendar year 2021, using the latest facts and figures available to City administration. The primary source of the City’s annual revenue comes from property taxes payable in a calendar year. The City must certify its final tax levy by December 28, 2020. Therefore, the city council will be discussing the proposed final operating budget and associated tax levy at its regularly scheduled monthly meeting on December 9, 2020, beginning at 6 p.m.

Proposed budget

The city council approved a proposed 2021 operating budget during its regularly scheduled monthly meeting on September 9, 2020. The proposal included expenditures totaling $253,200 and revenues of $268,296. The proposed tax levy, required to be submitted to the County Auditor/Treasurer by September 30, was set at $165,523. That represented a 4% increase to the 2020 final tax levy set at $159,157. In any given year, the proposed certified tax levy cannot be increased; however, it can be decreased when final certification is approved by the council in December. The proposed 2021 operating budget and proposed 4% tax levy increase was approved by Mayor Johnson, Councilmember Ernst, Councilmember Shanks and Councilmember Warner; Councilmember Gossman was absent. Approved expenditures to the proposed operating budget included:

- The creation of a Deputy City Clerk position (16 hours/week, starting proposed wage of $15/hour with PERA benefits) to oversee the utility billing program and handle front-of-office needs. The clerk/treasurer position would transition to an administrative role focusing on long-term planning/budgeting. Cross-training would become an essential staff function. (Note: An additional administrative employee has been recommended by the City’s auditing firm.)

- The transition to a new fund accounting and payroll software system designed for municipalities. (Note: This is another recommendation by the auditing firm.)

- The elimination of General Fund dollars for street repaving projects. Planning for complete street reconstruction projects, including utilities infrastructure, becomes the alternative method. Projects would be funded through a combination of loans, grants and special tax assessments. The creation of a Capital Outlay line item would be added to the Streets Budget.

- The inclusion of additional funds to make exterior repairs to the former school bus shed on Prairie Avenue (now used for City storage), replace the deteriorating wooden gazebo at the veterans memorial site with a metal structure, and additional equipment purchases for the Streets Department.

Proposed final budget

The proposed final operating budget reflects actual year-to-date spending through the month of November 2020. Figures for the month of December 2020 are estimates based on budget forecasts. The proposal includes General Fund expenditures totaling $257,945 (an increase of $4,745 from the approved proposed budget) and revenues of $260,180 (a decrease of $8,116 from the approved proposed budget). That decrease is largely due to a proposed reduction to the certified proposed tax levy. Forecasted revenue is sufficient to cover 2021 budgeted expenses without an increase to the tax levy. Under this scenario, property taxes payable to the City in 2021 will remain at the 2020 level, generating $159,175 in annual revenue. Proposed expenditures to the final operating budget include:

- Administrative staff wages totaling $26,400. This includes the current City Clerk/Treasurer position (24 hours per week) and proposed Deputy City Clerk position (16 hours per week). A 1.3% Cost of Living Adjustment (COLA) is included for the City Clerk/Treasurer. The Deputy Clerk will begin employment with the City in 2021. Currently, the City Clerk/Treasurer’s wages are paid 60% from the General Fund and 40% from the Water and Sewer Funds. The 2021 budget accounts for a 75-25 percent split in wages, due to the restructuring of the job description. 75% of the City Clerk/Treasurer’s wages will come from the General Fund, with 12.5% from the Water Fund and 12.5% from the Sewer Fund. The Deputy City Clerk’s wages will be paid largely through the Water and Sewer Funds – 40% from Water and 40% from Sewer. The remaining 20% will come from the General Fund. Public Employees Retirement Association (PERA) contributions and Federal Insurance Contributions Act (FICA) deductions, which includes Social Security and Medicare, were not calculated for the 2021 proposed budget.

- Maintenance staff wages totaling $52,625. This includes the current Public Works Director position (40 hours per week) and current Public Works Maintenance position (20 hours per week). A 1.3% COLA is included for both of these positions. There are no proposed changes to the funding sources for either Public Works positions.

Next steps

The city council is encouraged to review the proposed final 2021 operating budget and request any additional information from City staff prior to the December 9 meeting. The public is encouraged to be involved with the budget approval process. There will be a time for public comments during the council meeting, which will take place at the Canton Town Hall. A vote is expected during the December 9 meeting, to allow sufficient time for the final tax levy certification.